This piece, detailing legal considerations for companies wishing to release esports NFTs, was written by Jim Gatto, partner in the Intellectual Property Practice Group in the Washington, D.C. office of law firm Sheppard Mullin. He is Leader of the Blockchain & Fintech Team, Social Media & Games Team and Open Source Team.

Within the blockchain space, one of the fastest-growing areas is NFTs. Within the games space, esports is growing rapidly. So naturally the combination of NFTs and esports should have tremendous potential. This article will explore some opportunities at the intersection of these trends and some of the potential legal issues that might arise.

NFTs

NFTs are non-fungible tokens. Each token is unique and represents rights to some asset — either digital or physical. The token is created and recorded using blockchain technology. The asset that the token represents typically is not stored on a blockchain. The token typically references the underlying asset and its location via metadata specified in the token.

RELATED: G2 Esports partners with Bondly to launch NFT series

Some types of assets that have been the subject of NFTs include video highlights, trading cards and collectibles, and other forms of media such as digital art, pictures, music and much more. One of the most popular NFT marketplaces right now is NBA Top Shot. These are based on short video highlights from NBA games. The popularity of these NFTs propelled Dapper Labs, the platform’s creator, to a reported $7.5bn valuation. Could NFTs based on video highlights of esports competitions become as popular?

Esports

The opportunities for esports-based NFTs abound. As with other sports, NFTs can be based on highlights from esports competition, player images, and other digital collectibles including perhaps a key weapon used to win a competition, other esports-related memorabilia, or esports-related artwork. NFTs can also be used for ticketing to live events and much more.

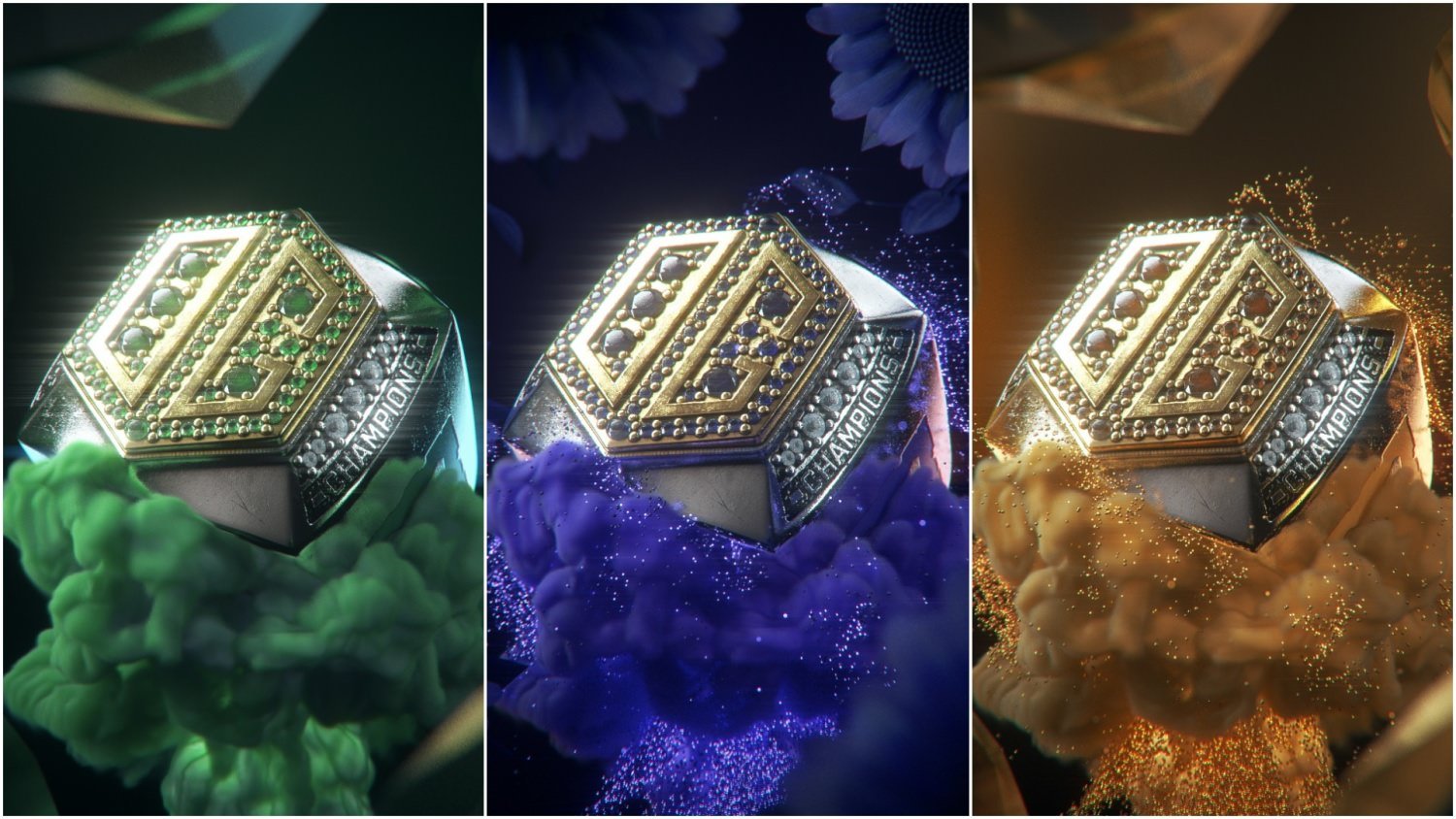

Fan tokens are another type of token that have become popular. Fan tokens are designed to create engagement between fans and teams. The rights associated with fan tokens can vary including certain governance rights, unique access to content, rewards and more. For example, the OG Esports Fan Token includes governance rights that give fans a tokenised share of influence on team decisions through voting in surveys. Team Alliance, Team Heretics and Natus Vincere have also launched fan tokens.

Legal issues in esports NFTs: Licensing

One of the most fundamental legal issues with NFTs is the scope of rights the NFT represents. Typically, an NFT represents a licence to the instance of digital media associated with the NFT, but the underlying copyright is retained by the copyright owner. Thus, while platforms that sell NFTs refer to ownership of NFTs, it is important to understand that while the token part of the NFT may be owned by the purchaser of the NFT, typically the rights in the digital media file are not.

Dapper produces its NFTs of NBA highlights under licence from the NBA. With esports, licence rights might be more complex. In esports there are several entities that may have certain rights that could be relevant. This may include the game publisher, teams, leagues, players, the tournament organiser and potentially others. Anyone creating an esports-based NFT needs to ensure that they have all of the necessary rights from the right entity or entities.

For example, if an NFT includes esports highlights that depict playing the game, it may be necessary to obtain rights from the game publisher, unless the fair-use doctrine or other exception applies.

Many NFTs have incorporated third-party IP without permission. Sometimes, NFTs have included third-party IP as part of the content. In other cases, third-party IP alone has been the content. IP owners, whose content is being used in NFTs without permission, are taking note and ramping up their enforcement efforts.

When licensing rights to NFTs, it is important to be clear what is and what is not being licensed. When licensing IP for use in an NFT, the licence should be limited to that purpose and other restrictions should be considered. Typically, the licence will reserve all other rights to the IP owner. For example, a creator may grant rights to create a limited number of NFTs associated with a copyrighted work, to maintain the scarcity (and associated value) of the NFT based on such work. As another example, a licensor may choose to expressly prohibit, or impose restrictions on the right of the licensee to make modifications associated with the licensed work for purposes of the NFT. This is particularly important given the growing prevalence of layered art, programmable art and generative art. Each technique can cause your IP to be used with other IP or to be modified in ways you may not desire.

“Licensors can ensure their cut of NFT resale revenue with well-drafted licence agreements”

IP owners who grant rights to create NFTs based on their IP may wish to clearly address revenue-share issues for both the sale and resale of any NFTs. Many NFTs are structured so the NFT ‘creator’ gets paid on the initial sale, but also (via smart contracts) on any resale. Licensors can ensure their cut of NFT resale revenue with well-drafted licence agreements.

Given the increasing number of NFTs that are not properly licensed, it is important for IP owners to consider rethinking their IP protection strategy. For example, teams, event organisers, leagues, sponsors, and game companies should consider extending their trademark registrations to cover trademark uses and classifications that include NFTs. They may also choose to associate certain designs or trade dress with their brand.

Design patents

Design patents should also be considered, where appropriate. Design patents are particularly valuable since profits from the sale and resale of NFTs can be significant. And unlike trademark, trade dress and copyright protection, the owner of a design patent can be entitled to all of an infringer’s profits, not just the portion of profits attributable to the use of the design. Design patents cover the ‘visual ornamental characteristics’ of an article and can include such visual aspects of screen displays.

Teams selling esports fan tokens in the United States need to ensure they understand U.S. securities law. A number of fan tokens have increased in value and are bought and sold on secondary markets. If a fan token is structured in such a way that it looks like an investment, it may fall under the regulation of the U.S. Securities and Exchange Commission (SEC). The primary test used by the SEC is whether the purchaser makes: an investment of money; in a common enterprise; with an expectation of profit; based on the efforts of others. In some cases, the common enterprise could be the team and the profit from the tokens could be based on the efforts of the team.

RELATED: WePlay Esports to launch its first NFTs on Binance

These are just some of the legal issues that should be considered when dealing with esports-based NFTs. There can be a host of other issues depending on the business model and other technical factors. These legal issues can include anti-money-laundering, gambling, or tax. For more information on this please see Protecting IP and Limiting Liability When Licensing IP for Digital Art and NFTs.

Read The Esports Journal

Created in collaboration with Sheppard Mullin

Source: Read Full Article